Don’t Let Credit Card Processors Take Advantage of You

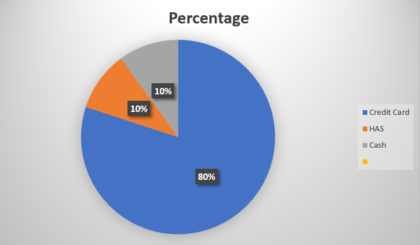

If you’re in the alternative medicine industry, most of your revenue is probably derived from credit card transactions, as many insurance companies usually do not cover your services.

But do you understand your credit card merchant account? Do you know how much you should be charged for each of your transactions? Many businesses don’t… and that’s where we come in.

Setting the Scene

A few months ago, we were referred to an alternative medicine clinic in Central Florida. When we met with the doctor, she shared that she thought she was paying too much for her credit card processing.

Since she had inherited the account from the previous doctor, she never got the opportunity to sign up for a new account and thus didn’t quite understand processing, fees or what she was being charged for and why… and no one was offering to show her.

The MCS Outcome

We (Merchant Consulting Service) performed a complete analysis of her merchant account and prepared a comparison for her: Our comparison showed her she was overpaying by nearly $1,000 every month (on an account doing about $100,000 monthly) and that she was also paying an extra $42 per month for an expired terminal lease.

To solve this, we set up a new merchant account for the doctor’s clinic, thereby eliminating all unnecessary fees and going forward, our DACTA® process will ensure she always pays what we promise.

Obviously, this doctor was very happy with MCS’s services.

We Can Help You

If you feel that your merchant account is not set up properly, or just want to learn more about your fee structure and now it impacts your bottom line, e-mail Britt (britt@merconserv.com), call us at 321-800-6533 or fill out the contact form below. We look forward to serving you.